In recent years, due to the aging and poor management of the power generation facilities of the state-owned power company ESKOM, South Africa is facing a worsening power crisis. Long-term large-scale power rationing has caused serious losses to the country's economy. Against this background, South Africa has turned its attention to renewable energy including photovoltaics.

South Africa's photovoltaic policy and market overview

According to ESKOM's data, by the end of 2023, South Africa's cumulative photovoltaic installed capacity will be about 7.3 GW, of which distributed projects account for about 5 GW and centralized projects account for about 2.3 GW. In order to fill the gradually widening power gap, the South African government has proposed a series of policies to promote the development of photovoltaics.

First, let's look at distributed projects. From March 2023 to March 2024, the South African government implemented tax breaks for household photovoltaics. As long as photovoltaic modules above 275 W are installed, a tax rebate of up to 25% can be received, and each person can get a maximum tax rebate of 15,000 rand (about US$795). In addition, in August 2023, South Africa issued the Energy Bounce Back Scheme (EBB), where households and small and medium-sized enterprises can apply to banks for loans of up to 300,000 rand (about 15,900 US dollars) and 10 million rand (about 530,000 US dollars) respectively, for the installation of photovoltaic modules, energy storage batteries and other equipment. In terms of centralized projects, South Africa began to implement the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) in 2011, which is the main source of centralized installations in South Africa. As of 2023, six rounds of bidding have been completed. The latest seventh round of bidding was originally expected to end in April 2024. However, at the end of May 2024, the government announced that the deadline for bidding will be postponed to August. On the other hand, South Africa also provides tax breaks for large-scale renewable energy projects. For investment projects from March 2023 to March 2025, companies can apply for a tax rebate of up to 125% on capital expenditures in the first year.

In general, due to large-scale power restrictions and rising electricity prices, supplemented by policy support, South Africa's photovoltaic installations are mainly distributed projects for self-generation and self-use. In 2023, South Africa will add 2.5 GW of distributed installations, compared with 1.7 GW in 2022, a year-on-year increase of 47%. In contrast, South Africa's centralized installations have stagnated. Taking the fifth round of REIPPPP tendered in 2021 as an example, many projects were originally planned to be connected to the grid in 2023, but due to lengthy financing and administrative processes, they were forced to postpone their production until after 2024. In addition, ESKOM's insufficient absorption capacity is also the main cause of the delay. Some renewable energy projects cannot even reach full production due to grid load problems, which in turn affects the developer's electricity sales revenue.

Outlook for South Africa's photovoltaic market

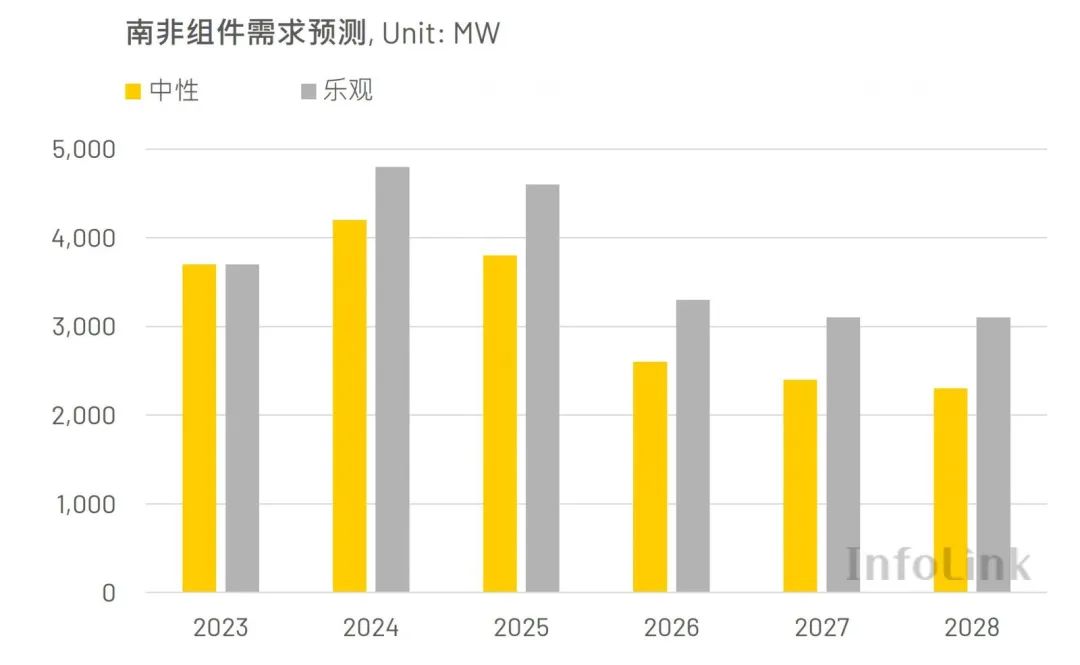

Due to the obstacles faced by centralized installations, the South African government has recently focused on simplifying administrative procedures and improving the power grid. For example, at the end of March 2024, South Africa announced that future centralized photovoltaic projects will not need to apply for environmental impact assessment permits after comprehensive assessment of location, installed capacity and environmental impact, in order to accelerate project grid connection. Combined with the deferred projects in 2023 and the demand volume in 2024, Infolink predicts that the demand for photovoltaic modules in South Africa will reach more than 4.2 GW in 2024, an increase of about 13.5% compared with 3.7 GW in 2023.

However, in the long run, ESKOM's financial problems will be a major concern for the grid connection of centralized projects. At the end of 2021, developed countries such as the United States and the United Kingdom proposed the Just Energy Transition Partnership (JETP) in the hope of funding South Africa's energy transformation. As of the end of 2023, the plan has raised about US$8.5 billion, but according to the South African government's corresponding long-term investment plan, its overall funding needs have reached US$98 billion, which includes organizational adjustments and bailout budgets for ESKOM. South Africa has been trying to solve the huge debt of this state-owned company for many years. On the other hand, the government's policy support for photovoltaics may also weaken. According to South Africa's 2023 version of the draft Integrated Resource Plan (IRP 2023), the photovoltaic installation target has been changed to 3.6 GW of centralized projects from 2023 to 2030, lowering the 6 GW target set in the previous version of IRP 2019, while the proportion of traditional energy generation has increased.

Looking at the South African PV market, although distributed projects can provide some support for long-term component demand, considering ESKOM's financial situation, centralized projects may still be constrained by grid absorption issues, and the South African government has not released more large-scale incentive policies. Therefore, after experiencing growth in 2023 and 2024, InfoLink expects that South Africa's component demand will decline after 2025, and the future market trend still needs to be observed.

online service

online service +86 (0592)5663849

+86 (0592)5663849 sales@uisolar.com

sales@uisolar.com solar-mount.au

solar-mount.au