Under the global trend of net-zero carbon emissions, Southeast Asia due to its abundant sunshine, rapid economic growth, accompanied by industrial transformation brought about by the rise in demand for green power, photovoltaic has become the mainstay of the local development of renewable energy.Vietnam, Thailand, Malaysia, Philippines and Singapore, the five major photovoltaic demand countries, with the recent introduction of a series of favorable policies, is expected to drive Southeast Asia to become one of the key photovoltaic market.

Policy Developments in Southeast Asia

Vietnam

On July 3, 2024, Vietnam passed a multi-year Direct Power Purchase Agreement (DPPA) that allows purchasers to purchase green power through the national or private grid, but requires a monthly consumption of at least 200,000 kWh. For PV suppliers to use the national grid, the installed capacity must be at least 10 MW, while the private grid is not subject to this restriction.

On July 30, 2024, the government issued Circular No. 356/TB-VPCP, clarifying the definition of "self-generation and self-consumption rooftop photovoltaic projects" as projects in which the amount of electricity sold back to the national grid accounts for less than 10% of the total installed capacity (with a relaxation of up to 20% in the northern region), and thereafter removing the limitations on the amount of installed capacity of rooftop photovoltaic projects that are not grid-connected and streamlining the application process, and the officials will subsequently announce the details of the tariff and measures relating to the photovoltaic storage package. Officials will subsequently announce tariff rules and measures related to photovoltaic storage.

Thailand

Unlike Vietnam, which has formally adopted the DPPA, Thailand has chosen to start a gradual trial in June 2024, limiting large-scale users to purchase up to 2 GW of green power directly, and officials are expected to release clear guidelines and details of the country's DPPA by the end of 2024.

On the other hand, Thailand will also publish a new version of the Electricity Development Plan in September 2024, with energy security, environmental protection and tariff control as the main axis of the policy, to maintain economic growth must also take into account the energy transition. In general, with the demand for green power becoming more and more urgent, Thailand's new version of the photovoltaic installed capacity target will also be further increased.

Malaysia

On July 26, 2024, Malaysia announced that it will implement the Corporate Renewable Energy Supply Scheme (CRESS) in September 2024, which is similar in nature to the DPPA in that it also aims to liberalize green power trading, so that power purchasers and suppliers will be able to enter into agreements directly without having to go through the National Energy Corporation. The policy is similar in nature to the DPPA, and also aims to liberalize green power trading.

It is worth noting that the purchasers of electricity under the scheme are limited to industrial and commercial users of medium and high voltage electricity, and it is stipulated that the scheme can only be applied when there is an "additional demand for electricity", and the old users are not able to participate in the scheme. As for the power supplier, it will still have to transmit power through the national grid and pay for the usage fee, and will not be able to use the private grid. In addition,since the CRESS policy file has not yet been announced, it is still necessary to wait for the officials to clarify the details of the regulations and the way to implement the program.

Philippines

A five-month moratorium on renewable energy project applications was announced as of June 25, 2024, in an effort to update energy-related policies, but officials also emphasized that the progress of projects that have already been applied for will not be affected. According to the country's Department of Energy (DOE), as of March this year, more than 32 GW of PV projects in the Philippines were either under approval or under development.

Future policy updates are expected to free up developers to apply for licenses by 2025 without having to wait for DOE approval. At the same time, the new regulations will also significantly simplify the administrative process of applying for duty-free imports of project products.

Singapore

Singapore can be said to be the most mature photovoltaic policy surface of Southeast Asian countries. However, because of its geographical constraints, the local difficult to build large-scale photovoltaic projects.In recent years, the country is turning to neighboring countries to import green power, and vigorously promote the integration of cross-border power grids, planning for 2035 before importing more than 4 GW of green power.

In April 2024, Singapore and Malaysia's cross-border energy trading platform will start a trial run, and Malaysia will make 100 MW of green power available for subscription by Singaporean customers through the power grid, and then in June 2024, Singapore plans to acquire more than 200 MW of green power through multinational power trading.

Opportunities and Challenges in the Southeast Asian PV Market

In addition to policy impetus such as liberalization of green power trading, the injection of foreign capital also plays an important role. The growth potential of Southeast Asia cannot be ignored, and the potential business opportunities brought about by the topic of energy transition also bodes well for the huge potential of the PV market in Southeast Asia.

However, although the potential is huge, but at this stage the Southeast Asian photovoltaic market is still facing many challenges:

First of all, is the insufficient capacity of the power grid,and then is the Southeast Asia's rich coal, hydro resources crowded out the development of photovoltaic space. And the traditional energy industry in Southeast Asia occupies a dominant position to support the economic growth of many countries. The promotion of energy transition means that most coal-fired power plants that have been in operation for less than 20 years must be retired early, which is not in line with the efficiency of investment.

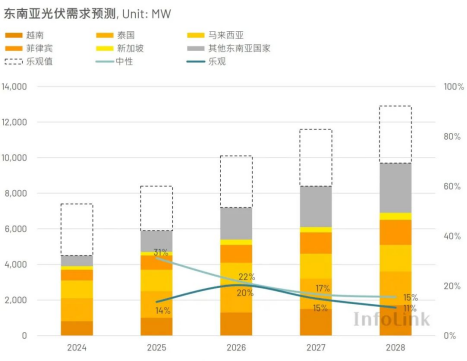

Overall, Southeast Asia has economic growth, policy promotion and international funding support, coupled with grid consumption issues and competitive pressure from other energy sources, InfoLink expects PV demand in Southeast Asia to fall to 4.5-7.4 GW in 2024, and the long-term demand is expected to grow to 9.7-12.9 GW,and expects that Southeast Asia's PV market will maintain steady growth in the coming years. It is expected that the PV market in Southeast Asia will maintain steady growth in the coming years and become an important part of the global energy transition.

online service

online service +86 (0592)5663849

+86 (0592)5663849 sales@uisolar.com

sales@uisolar.com solar-mount.au

solar-mount.au